The Greed Fear Index Crypto is a powerful tool helping cryptocurrency investors gauge the overall market sentiment. Understanding this vital index aids in identifying potential opportunities and avoiding unnecessary risks, enabling more informed trading decisions in the volatile crypto world, crucial for navigating this dynamic landscape.

What is the Greed Fear Index Crypto?

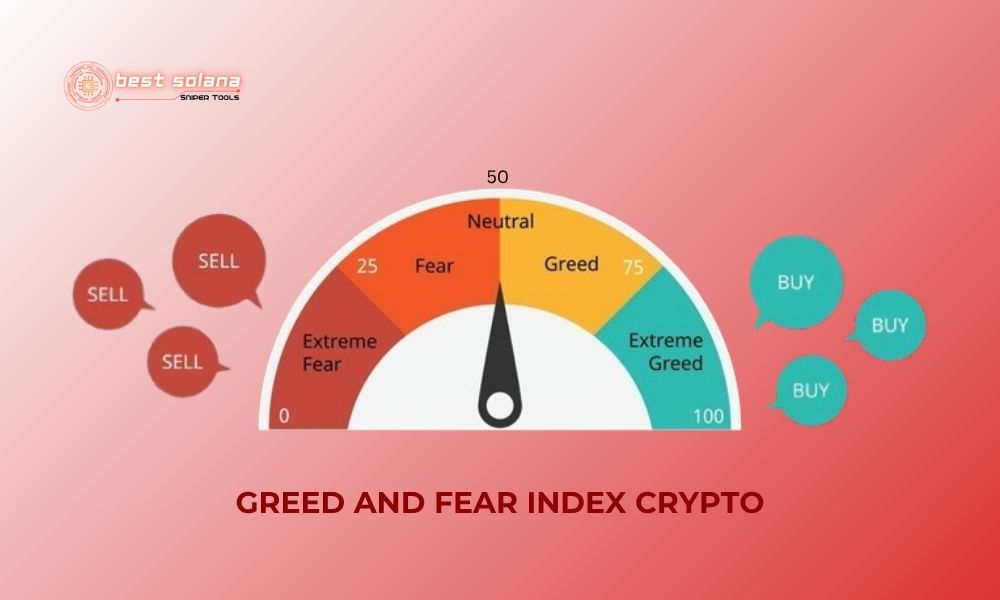

The Greed Fear Index Crypto, also known as the crypto fear and greed index, is a tool that measures the general sentiment of investors in the cryptocurrency market. This index is represented on a scale from 0 to 100.

- 0-24 (Extreme Fear): Indicates that investors are very worried and pessimistic. This could be a sign that the market is oversold, presenting a potential buying opportunity.

- 25-49 (Fear): Investors are still hesitant; the market tends to decline or move sideways.

- 50 (Neutral): The market is not leaning strongly towards either greed or fear.

- 51-75 (Greed): Investors are optimistic and tend to buy more.

- 76-100 (Extreme Greed): Shows excessive excitement in the market. This could be a sign that the market is due for a price correction downwards. Essentially, the Greed Fear Index Crypto operates on the principle popularized by legendary investor Warren Buffett: “Be fearful when others are greedy, and greedy when others are fearful.”

Components of the Greed Fear Index Crypto

The Greed Fear Index Crypto is not a random number but is compiled from various data sources. The main factors typically include:

Market Volatility (usually accounts for 25%): Compares the current volatility of Bitcoin (or a basket of major cryptocurrencies) with the average over the past 30 and 90 days. A sudden increase in volatility is often a sign of a fearful market.

Market Momentum/Volume (usually accounts for 25%): Compares current buying and selling volumes with the average over the past 30 and 90 days. When there’s consistently high buying volume on strong up-days, it’s a sign of a greedy market.

Social Media (usually accounts for 15%): Analyzes the number and frequency of posts and hashtags related to specific cryptocurrencies on social media platforms like Twitter. High engagement and positive sentiment often indicate greed.

Surveys (usually accounts for 15%, can vary): Some indices conduct weekly surveys with investors to gauge their feelings about the market.

Bitcoin Dominance (usually accounts for 10%): Changes in Bitcoin’s market capitalization share relative to the total crypto market cap. When investors are fearful, they tend to move into Bitcoin as a “safe haven” within the crypto world, increasing Bitcoin’s dominance. Conversely, when the market is greedy, money may flow into riskier altcoins.

Search Trends (Google Trends – usually accounts for 10%): Analyzes data from Google Trends for keywords related to Bitcoin and cryptocurrencies. For example, a surge in searches like “buy Bitcoin” can indicate greed, while negative searches might reflect fear.

Each of these factors is assessed and scored, then aggregated to produce the final Greed Fear Index Crypto.

Importance of the Greed Fear Index Crypto

Tracking the Greed Fear Index Crypto offers several benefits for investors:

- Understanding market sentiment: Helps investors get an overview of the emotions driving the market, whether the crowd is euphoric or pessimistic.

- Identifying Potential Opportunities: When the index is at “Extreme Fear,” it might be a good time to consider buying, as prices could be low due to panic selling. Conversely, “Extreme Greed” could be a signal to consider taking profits or exercising more caution.

- Avoiding emotional decisions: By recognizing the general sentiment, investors can avoid being swayed by herd mentality (FOMO – fear of missing out, or FUD – fear, uncertainty, doubt).

- Supplementing technical and fundamental analysis: The Greed Fear Index Crypto should not be used in isolation but combined with other analytical methods for comprehensive investment decisions.

How to use the Greed Fear Index Crypto effectively

To make the most of the Greed Fear Index Crypto, investors should:

Not Treat it as a Holy Grail: It’s just a sentiment indicator, not a 100% accurate predictor of market movements.

Combine with other indicators: Use it alongside technical chart analysis (support/resistance levels, RSI, MACD, etc.) and fundamental analysis (project news, development roadmaps, team, etc.).

Define a personal strategy: Make decisions based on your risk appetite and investment goals (short-term or long-term). For instance, long-term investors might consider a dollar-cost averaging (DCA) strategy when the market is in the “Fear” zone.

Be patient and disciplined: The market can remain in a state of “greed” or “fear” for longer than expected. Patience and adherence to your established strategy are crucial.

In conclusion, the Greed Fear Index Crypto is crucial for gauging market sentiment and making informed decisions. For ongoing analysis of the Greed Fear Index Crypto and other essential crypto market insights, follow Best Solana Sniper.