What is a MEV Bot? It’s an automated program designed to extract Maximal Extractable Value on blockchains. These bots analyze the mempool, seeking trading opportunities like arbitrage and liquidations, automatically executing strategies to maximize operator profits. Understanding what a MEV Bot is offers deeper insight into the complex dynamics of decentralized finance (DeFi).

What is MEV?

Before diving into the specifics of what a MEV Bot is, we must first understand the concept of MEV. MEV stands for “Maximal Extractable Value,” previously known as “Miner Extractable Value.” It represents the total value that a validator or block producer can capture by ordering, including, or excluding transactions within a block they are creating.

On public blockchains like Ethereum, pending transactions reside in an area called the mempool (memory pool). Block producers have the authority to select and order transactions from the mempool to include in a new block. This power allows them to prioritize transactions that offer them the highest benefit, beyond standard block rewards and transaction fees. This is precisely where the opportunity to extract MEV arises.

What is a MEV Bot?

So, to directly answer the question, what is a MEV Bot? A MEV Bot is an automated software program (bot) specifically engineered to identify and capitalize on Maximal Extractable Value (MEV) opportunities present on a blockchain. These sophisticated programs are the digital bloodhounds of DeFi, constantly sifting through the complex data streams of pending transactions.

These bots tirelessly scan the mempool, searching for specific transaction patterns, arbitrage possibilities, or liquidation events that could yield profit. Once such a lucrative opportunity is detected, the MEV Bot automatically formulates and submits its own transactions, frequently using higher gas fees to gain priority processing, all with the goal of capturing that identified value. Understanding what a MEV Bot entails is truly crucial for anyone navigating the intricate DeFi space.

How MEV Bots work

The operation of a MEV Bot relies on complex algorithms and sophisticated strategies. Here are some common mechanisms by which they function, further clarifying what a MEV Bot does:

- Mempool monitoring: MEV Bots constantly supervise pending transactions in the mempool. They look for large transactions, arbitrage opportunities, or potential liquidation scenarios.

- Opportunity analysis: Based on the collected data, the bot analyzes whether an MEV opportunity exists. For instance, if a large trade is about to be executed on a decentralized exchange (DEX) and is likely to cause significant price slippage, the bot might identify this as an opportunity.

- Strategy execution: After identifying an opportunity, the MEV Bot will automatically create and submit its own transactions to exploit it. Popular strategies include:

- Front-running: The bot detects a profitable transaction (e.g., a large token purchase on a DEX) and places its own transaction immediately before it with a higher gas fee. When the original large transaction executes, it pushes the price up, and the bot can sell its purchased tokens at a higher price for a profit.

- Back-running: The bot places its transaction immediately after a large transaction that has significantly altered the market state (e.g., a large swap creating an arbitrage opportunity).

- Sandwich Attack: This combines front-running and back-running. The bot places a buy order just before the victim’s large transaction (front-run), then places a sell order immediately after it (back-run), “sandwiching” the victim’s trade to profit from the price movement the bot itself induced.

- Arbitrage: The bot seeks price differences for the same asset across different DEXs and executes trades to buy where the price is low and sell where it’s high, earning a profit.

- Liquidations: In DeFi lending protocols, when a borrower’s collateral value drops below a certain threshold, their loan can be liquidated. A MEV Bot can monitor these loans and be the first to execute the liquidation to receive a reward. Considering what a MEV Bot can do in liquidations shows its efficiency.

Advantages and disadvantages of MEV Bots

The existence and operation of these bots raise many questions, especially when considering the impact. If we’re asking what is a MEV Bot in terms of its overall effect, we see both upsides and downsides.

Advantages (for bot operators):

- High profit potential: MEV Bots can generate substantial profits, especially in volatile markets.

- Automation: They operate 24/7 without continuous manual intervention.

- Speed: They execute trades much faster than humans can.

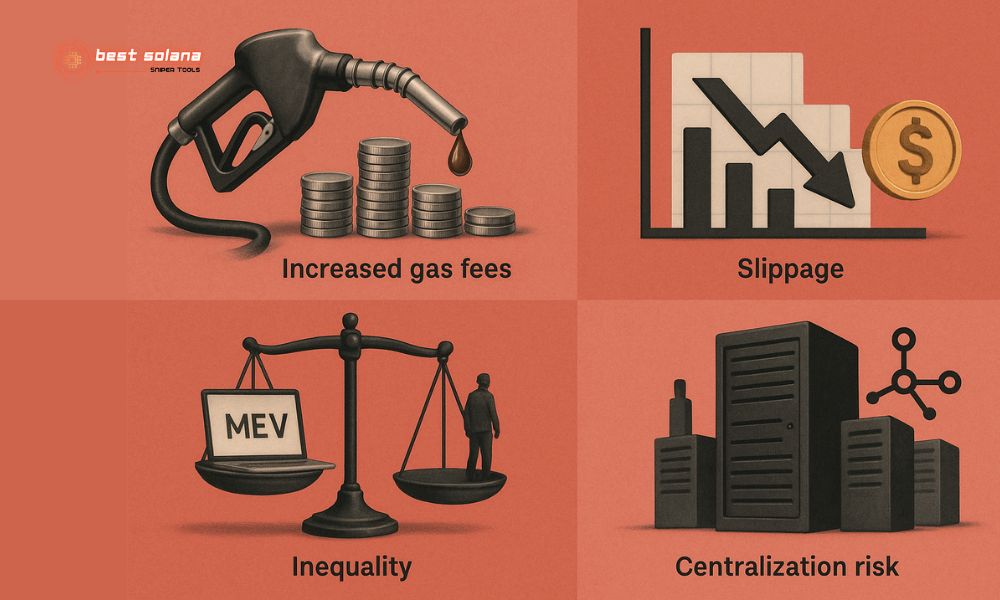

Disadvantages (for the ecosystem and regular users):

- Increased gas fees: The gas fee bidding wars among MEV Bots to get their transactions prioritized can congest the network and drive up gas fees for all users.

- Slippage: Strategies like front-running and sandwich attacks can cause regular users to experience greater slippage, receiving fewer tokens or paying more than expected.

- Inequality: Users with the technical knowledge and resources to operate a MEV Bot have an unfair advantage over ordinary users. The core of what a MEV Bot represents can sometimes be seen as exploitative.

- Centralization risk: The complexity and cost of developing and running effective MEV Bots could lead to the concentration of MEV extraction power in the hands of a few large players.

Understanding what is a MEV Bot? is vital for DeFi success, as these automated programs hunt for blockchain profit. For expert insights and to leverage powerful tools, especially within the Solana ecosystem, be sure to follow Best Solana Sniper for cutting-edge strategies and updates.