With the market cap of being a familiar term in crypto, have you truly grasped its meaning and importance when evaluating a coin/token? This fundamental metric helps crypto investors understand a project’s scale, potential, and risk level. Mastering this knowledge will boost your confidence as you explore the volatile crypto market.

What is “with the market cap of” in crypto?

The market capitalization (or market cap) of a cryptocurrency (coin/token) is the total market value of all its circulating coins or tokens. In simpler terms, it represents the total amount of money required to buy all the currently available coins/tokens of that cryptocurrency on the market at a specific time, based on its current price.

The formula to calculate market cap in crypto is straightforward: Market capitalization = Current coin/token price x Circulating supply

For example: Crypto project A has 100 million tokens in circulation, and the current price of each token is $2 USD. Therefore, with the market cap of $2 USD/token * 100,000,000 tokens = $200 million USD.

The importance of market cap in crypto

Market cap isn’t just a number. In the crypto space, it carries significant meaning:

Assessing project scale and position: It’s the most common way to compare the relative size of different crypto projects. Bitcoin and Ethereum, with market caps in the hundreds of billions, are considered “giants,” while new altcoins might only have market caps of a few million dollars.

Measuring risk and growth potential:

- Projects with a large market cap (large-caps) are generally considered more stable and widely adopted, but their potential for exponential growth (e.g., 10x, 100x) might be more limited.

- Conversely, small-cap or micro-cap projects can offer breakthrough profit potential but come with extremely high risks, including the possibility of project failure.

Basis for investment strategy: Crypto investors often use market cap to allocate capital. Some prefer the relative safety of top-cap coins, while others hunt for “hidden gems” among low-cap projects.

Impact on liquidity: Coins/tokens with larger market caps usually have higher liquidity on exchanges, making them easier to buy and sell with less price slippage compared to small-cap coins/tokens.

Indicator of market adoption: A steadily growing market cap often indicates that the project is gaining traction and trust from the community.

Classifying crypto projects by market cap

The crypto market is very dynamic, and classification thresholds can change. However, a common way to categorize projects is as follows:

- Large-cap: Typically projects with the market cap of over $10 billion USD. Bitcoin (BTC) and Ethereum (ETH) are prime examples. This group usually has high reliability and strong fundamentals.

- Mid-cap: Projects with the market cap of $1 billion to $10 billion USD. These are projects that often have established products, a decent community, and good growth potential, but still carry risks. Examples might include Solana (SOL) or Cardano (ADA) (depending on the time).

- Small-cap: Projects with the market cap of under $1 billion USD (this can be further divided, e.g., under $200 million USD). This group is diverse, ranging from promising early-stage projects to lesser-known ones. The risk is high, but so is the potential reward if chosen wisely.

- Micro-cap and Nano-cap: These are often new projects, memecoins, or highly experimental projects with very low market caps (a few million USD or less). This is the most speculative investment area.

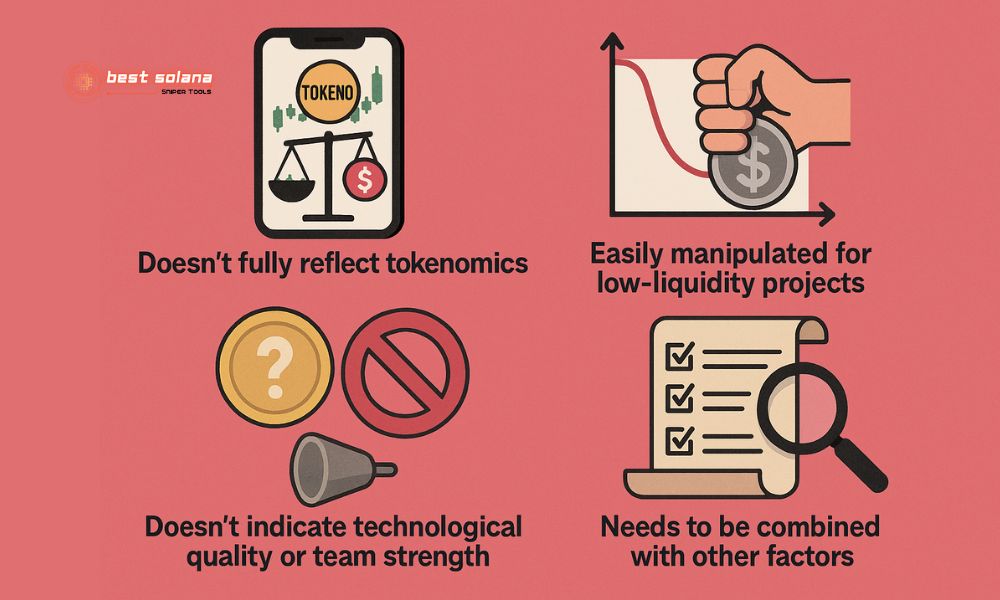

Limitations of relying solely on market cap in crypto

While an important metric, with the market cap of a project being its sole evaluation point is not enough and has certain limitations in crypto:

Doesn’t fully reflect tokenomics: Market cap is based on circulating supply, but the maximum supply and token vesting schedules are also critical. A project might have a low current market cap, but a large number of tokens scheduled for release could exert downward pressure on the price.

Easily manipulated for low-liquidity projects: For tokens with poor liquidity, a few large trades can artificially inflate the price and market cap.

Doesn’t indicate technological quality or team strength: A project can be heavily “shilled” (hyped) to temporarily boost its market cap without having real value in terms of technology, development team, or the solution it offers.

Needs to be combined with other factors: For a comprehensive assessment of a crypto project, you need to consider its whitepaper, technology, development team, partners, community, roadmap, and other technical analysis factors.

In essence, with the market cap of a crypto providing initial clues to its scale, remember thorough research beyond this figure is vital. For continuous learning, expert analysis, and the latest crypto updates to navigate this exciting market, be sure to follow Best Solana Sniper for valuable insights.